Tokenisation

Facing challenges with fraud or key security?

Reduce the risk of data breach

Unlike card numbers, network tokens are bound to the merchant. To a hacker, a merchant token is useless. They have been proven to reduce fraud by 26%.

Our tokens are merchant-specific, making stolen data redundant

Enhanced security reduces the risk of data breaches

Compliance with industry standards is simplified

Simplify PCI Compliance with Tokenisation

The Problem: Maintaining PCI compliance can be complex and costly, requiring rigorous security measures and annual audits to protect sensitive payment data.

Our solution:

Tokenisation replaces sensitive card data with unique tokens, reducing the amount of sensitive data that needs to be protected

Lower compliance costs by minimising the exposure of actual card data

With tokenisation, merchants streamline security by managing fewer sensitive data elements

Improve User Experience with Tokenisation

The Problem: Customers often experience frustration when they have to manually update their card information due to lost, expired or stolen cards. This can lead to higher cart abandonment.

Our solution:

Automatic card updates prevent transaction disruptions

Seamless checkout process enhances customer satisfaction

Reduced friction in recurring billing and subscription services.

FAQs

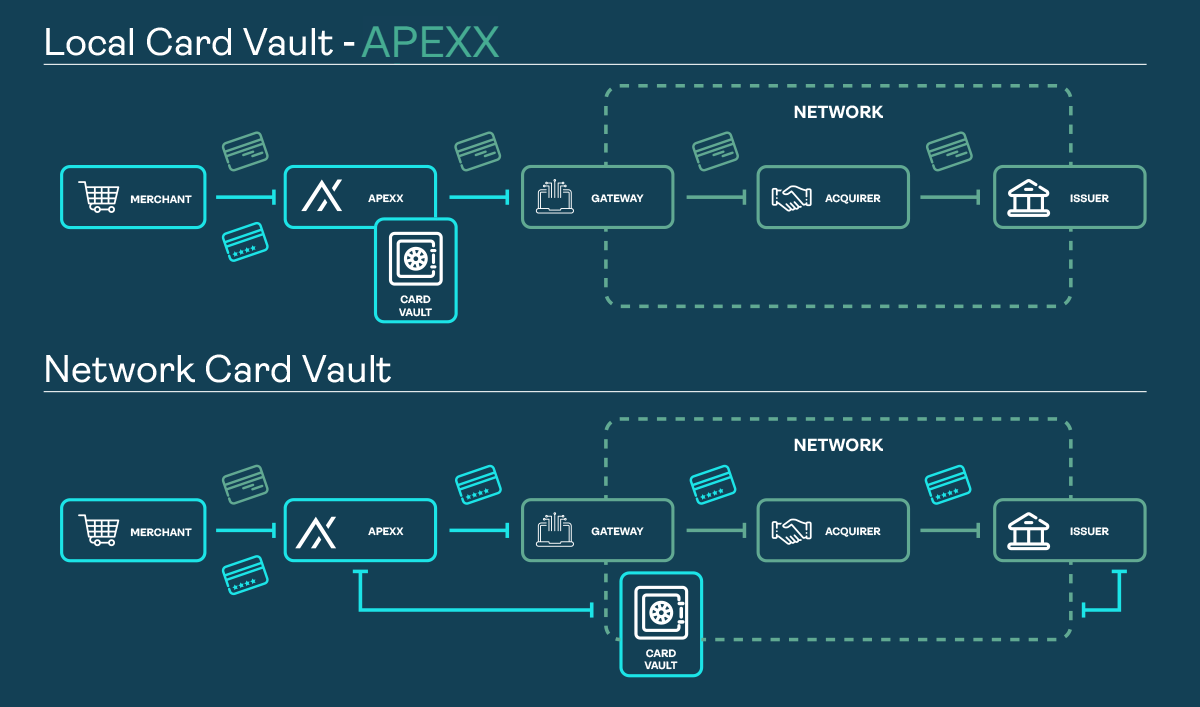

What's the difference between Network tokens and APEXX tokens?

Are merchants still in/out of PCI scope when using APEXX or Network tokens?

Using either APEXX tokens or Network tokens may reduce the scope of your PCI compliance as the storage of sensitive card data is now handled outside of your estate and stored safely with a certified party. This does not completely remove you outside of PCI compliance, but this does save you the overhead of the more stringent PCI levels.

What happens if APEXX or a Scheme goes down?

With APEXX, we offer PAN redundancy. Regardless of the status of the network for token detokenisation, we will be able to retrieve the underlying PAN and ensure the authorisation is attempted with your preferred acquirer. With APEXX our ATOMIC platform has 100% uptime (based on the last 18 months).

Can we use APEXX/Network tokens elsewhere?

As we are provider agnostic, we do not constrain your transactions to our system. If we have provided you with a network token, you are free to use this as intended, with any other gateway or acquirer that you are integrated with. The Network token is registered to you as a merchant and not to APEXX.

With APEXX tokens, you are limited to our system, as the card vault is located on our estate and not freely accessible to third parties. However the APEXX token can be used with any existing or new acquirer that you have connected via APEXX.

Can I store a single token and use it against multiple brands or regions within our business?

Yes, APEXX supports the ability to use a token created at one location within your hierarchy at any other location within your organisational setup to ensure you only need to maintain a single token per card for your customers.

Can I use a token for both stored card functionality and offline stored processing like MIT (Merchant Initiated Transactions) or Recurring transactions?

Yes, APEXX tokens can be used for Stored Card, an MIT or Recurring transactions. When using a token for Stored Card in countries where SCA is mandated you must initiate the 3DS flow using the BIN and the CardinalCommerce SDK to initiate the authentication process.